Medigap Plan M

Medigap Plan M is one of the newer supplements that was introduced in 2010.

It provides the same coverage as the other Medicare supplements. However, Plan M includes a slightly lower monthly premium while you pay half of your hospital deductible and 100% of your yearly outpatient deductible.

Who Should Choose Plan M?

If you don’t think you’ll go to the hospital that much and feel like you can afford some occasional cost-sharing, consider Plan M.

With that in mind, it’s a good idea to work with a licensed Medicare broker like Midwest Trusted Benefit. We specialize in Medigap policies and review the differences in premiums — making sure the savings are worth the risk of some costs. The best part? Our help is FREE!

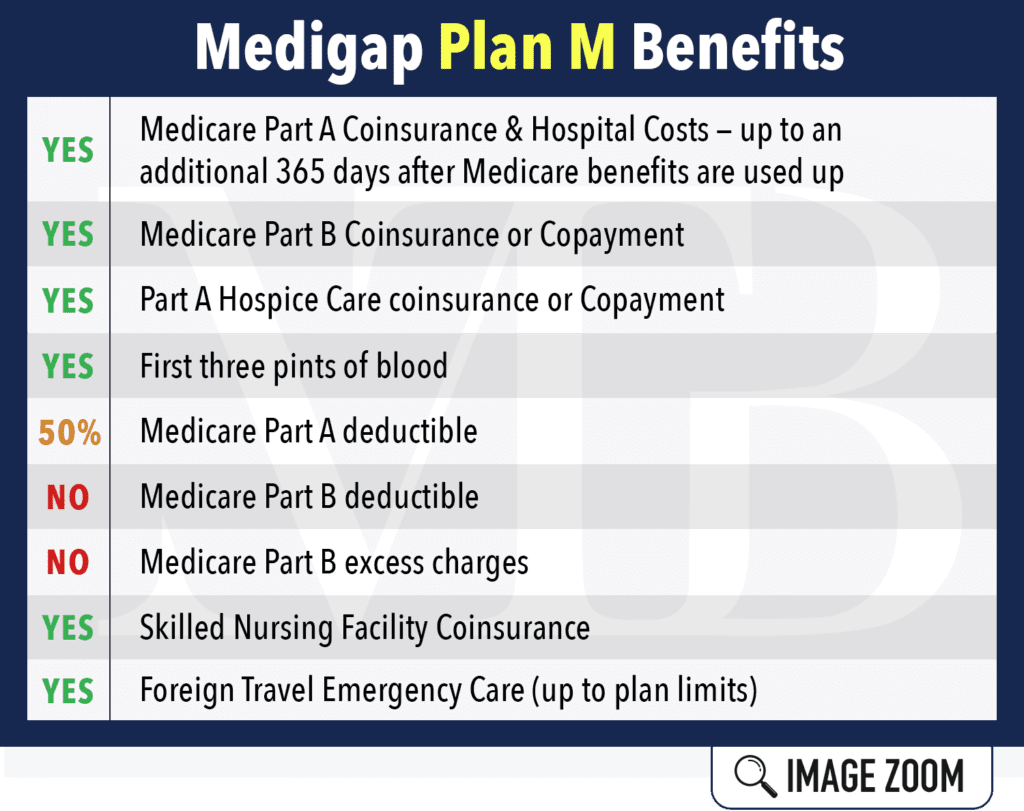

Medigap Plan M Benefits

Here’s a visual that can help you:

Medigap Plan M Scenario

Consider the following scenario:

Mrs. Jones buys a Medigap Plan M policy because of the apparent savings on premiums. She also has enough savings to pay for the periodic 50% coinsurance on the Part A deductible she could obtain. Three years into her policy, she needs hip surgery that requires her to stay in the hospital overnight. Mrs. Jones will pay for her (50%) share of the Part A deductible.

When she has outpatient follow-ups, her Plan M policy will cover most of them. She must first pay the yearly Part B deductible, but Medicare covers 80% of her outpatient care afterward. Her Medigap Plan M collects the other 20%.

If Mrs. Jones’ hip surgeon doesn’t accept Medicare assignment (given rates), she’ll also be responsible for the Part B excess charge. This surcharge will be no more than 15% above the Medicare-allowed amount. It’s a minimal charge, and Mrs. Jones is comfortable with her coverage.

So, this gives you a glimpse of what potential cost-sharing involves.

We'll Help You Decide if Plan M Is a Good Fit for You.

Cost-sharing can cause a lot of confusion, which is why we tend to see fewer companies offering Plan M. Trying to locate them can be a hassle, but if you get help from a trusted agent like us, we can give you FREE, quick quotes right over the phone.

We’re contracted with many Medigap insurance carriers in 15 states around the midwest. Call (402) 740-5505 or reach our team online.