Medicare Supplements

Medicare Supplements are also called Medigap plans because they help cover the “gaps” in Original Medicare like your deductibles and coinsurance.

They’re additional “supplemental” insurance plans that you can add to your Parts A and B. Medicare Supplements cover millions of beneficiaries nationwide. They’re very appealing to people who want little or no copays when they receive healthcare services.

Why Do People Buy Medicare Supplements?

If you’re new to Medicare, it may surprise you that Original Medicare only covers 80% of your Part B costs. That other 20% can be a major financial burden if a severe illness emerges.

You can select a Medicare Supplement plan that will cover some or all of that 20%, among other items. For seniors with Medicare, this extra insurance provides peace of mind by removing the cost-sharing responsibility. Should you become seriously ill, you’ll have more coverage and security with a Mediare Supplement.

Get a free medicare Consultation

- Compare Benefits

- Estimate Your Savings

- Get Enrollment Assistance

There Are Many Medicare Supplements

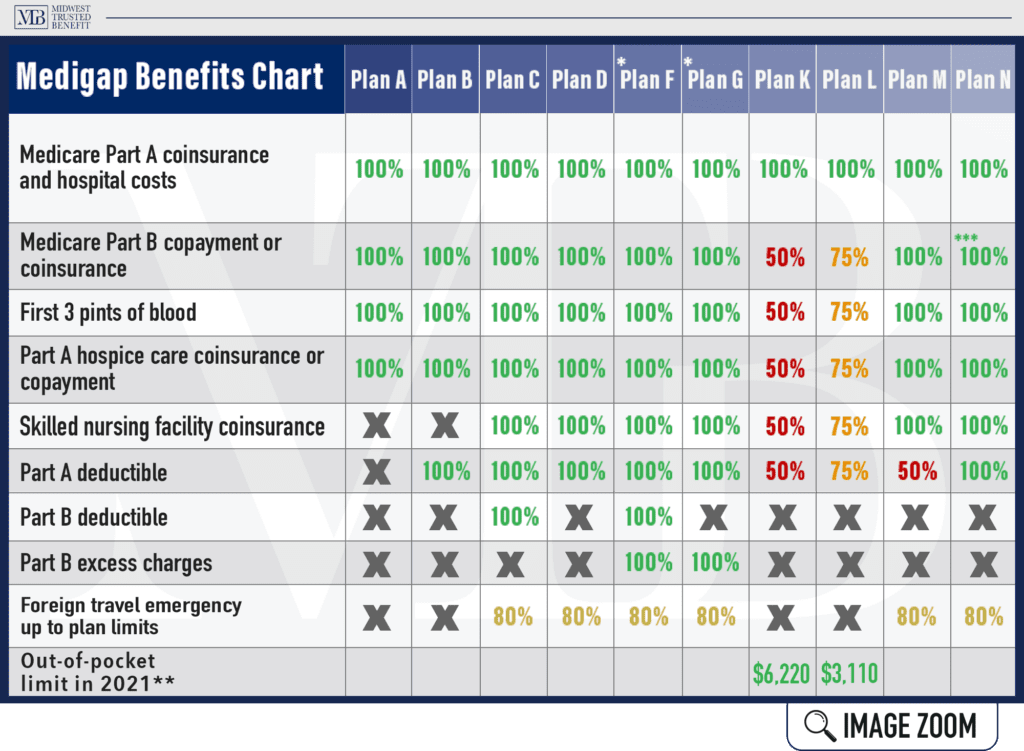

With many options, it can seem overwhelming at first. The standardized Medicare Supplement plans are listed below, plus high deductible versions of F and G.

- Medigap Plan A

- Medigap Plan B

- Medigap Plan C

- Medigap Plan D

- Medigap Plan F

- Medigap Plan G

- Medigap Plan K

- Medigap Plan L

- Medigap Plan M

- Medigap Plan N

- High Deductible Plan F

- High Deductible Plan G

Each plan offers different levels of coverage and the rates will vary depending on your state and the company you choose. The good news is that there’s an option for any and every health situation.

As an independent insurance broker, we work with people like you every day — providing quotes, answering questions, and making coverage recommendations so you can be confident in your decision.

How Medigap Insurance Works

The payments for Medicare Supplements can be explained in three steps:

- Doctor bills. Your doctor performs a service and bills Medicare.

- Medicare pays. Medicare will pay the approved portion of the bill and send the extra amount to Medigap.

- Medigap pays. Your Medigap policy pays the extra amount that remains, according to plan terms.

When to Enroll

For Medicare Supplement insurance, you get a one-time “Medigap enrollment window” to sign up — the best time to enroll because, during it, companies can’t ask you medical questions, nor can they deny you for health conditions. They also can’t charge you more for having health conditions. You’ll get your choice! You may enroll in any Medicare Supplement in your area.

Medigap open enrollment is a six-month window, starting on the first day of the month you turn 65 OR the month you sign up for Medicare Part B. It’s often called a “use it or lose it” opportunity.

After the period ends, you can still apply, BUT you’ll need to go through the underwriting process. So, future insurance carriers can choose to accept or reject you based on health.

Medicare Supplements - Guaranteed Issue

Some people wait to enroll in a Medicare Supplement plan since they have group health insurance through an employer. When they retire later or lose that coverage, they have the “right” to buy certain Medigap plans within the 63 days after losing the group coverage — known as a person’s Medigap “guaranteed issue rights.”

Guaranteed issue rules can differ by state. Check with an agent at Midwest Trusted Benefit — we can tell you about the laws that apply in Missouri, Kansas, Iowa, and Nebraska.

Medicare Supplements for Disabled People Under 65

If you’re disabled under 65, you probably have complicated conditions and might have a limited income. In that case, your out-of-pocket costs could be unending. A Medicare Supplement plan can help with these costs.

While your disability may qualify you for Medicare under 65, you’re not automatically eligible for Medigap insurance. It can be hard to get a Medigap policy, depending on where you live.

If a plan is available to you, the costs will likely be a lot higher than if you were 65 (or older).

- States aren’t required by federal law to offer Medicare Supplements for the disabled under 65.

- If you’re under 65 and have end-stage renal disease (ESRD), you may not be able to get a Medicare Supplement plan.

- The cost of these plans can increase each year. For disabled recipients under 65, these increases can be tough to manage. A Medigap premium may be okay in the beginning — but it becomes less affordable down the road.

It Depends on Your State

In Kansas and Missouri, insurance companies must sell at least one type of Medigap plan to people disabled under 65. Some restrictions may apply.

In Iowa and Nebraska, Medigap insurers aren’t required to offer policies to beneficiaries under 65, but some companies willingly provide coverage to the under-65 population. The bottom line? Coverage is available, including high-risk pool coverage, which our agents can share more info with you.

To confirm whether your state offers Medigap insurance if you’re under 65 and learn the details and restrictions, you can check with your State Health Insurance Assistance Program (SHIP).

Continue Browsing Our Site

To learn more about Medicare Supplements, keep browsing our website or call (402) 740-5505!