High Deductible Plan F

A high deductible version of Medigap Plan F is available to beneficiaries who first became eligible for Medicare before January 1, 2020 — meaning they turned 65 before this date or qualified for Medicare because of a disability before this date.

What Is High Deductible Plan F?

This plan provides the same benefits as regular Plan F, but the coverage will take effect AFTER you hit your calendar year deductible. The deductible is the amount you have to pay in out-of-pocket health costs before your plan begins cost-sharing.

Get a free medicare Consultation

- Compare Benefits

- Estimate Your Savings

- Get Enrollment Assistance

You Get a Lower Monthly Premium

The compromise for a high deductible plan is a significantly lower monthly premium. High deductible Plan F may be most fitting for cost-sensitive consumers who have fewer medical expenses throughout the year.

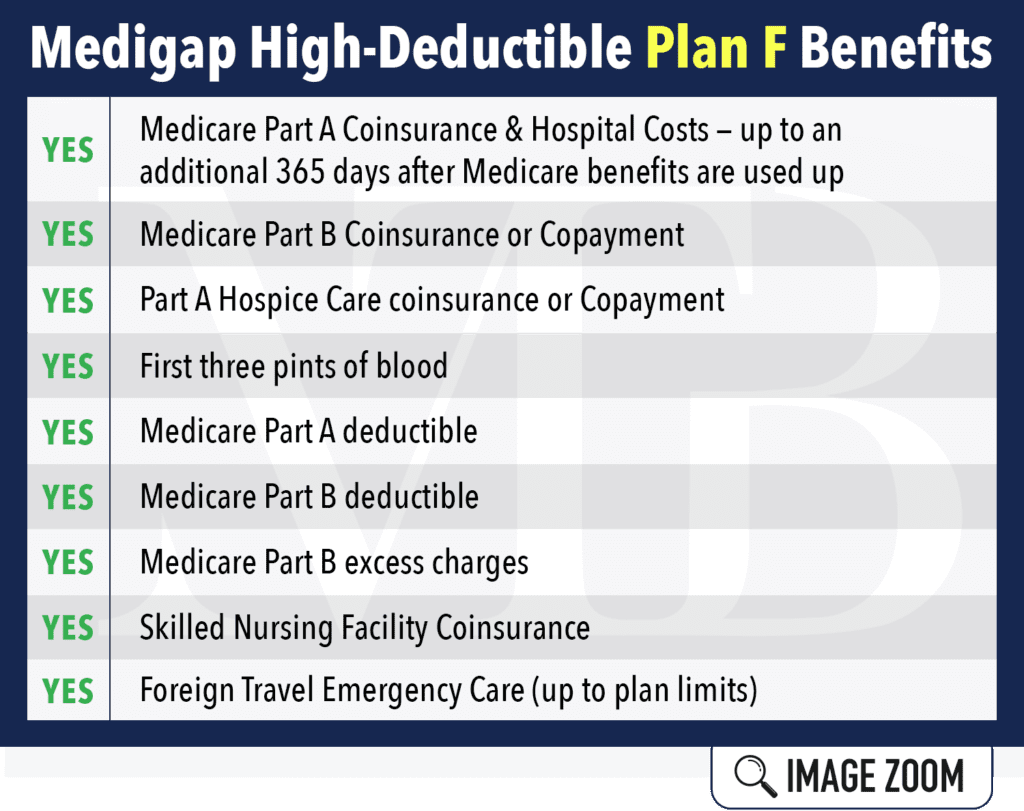

Check out the chart below for the coverage details or review the other Medigap plans.

How Does it Work?

First, Medicare pays its share (80%). Then, you agree on paying the first $2,370 of your portion (in 2021). That amount is the most you’ll pay on high deductible Plan F, called your maximum out-of-pocket.

Medigap High-Deductible Plan F Benefits

After you meet your annual deductible, your benefits are the same as regular Plan F:

Every year, Medicare adjusts the deductible, so it increases slightly over time.

Rates for High Deductible Plan F

The benefits of Medigap high deductible plan F stay the same no matter which insurance company or agency you choose. However, the pricing tends to vary depending on factors such as:

- Your age

- Your location

- Your gender

- Your overall health

With access to the top-rated companies in Nebraska, Iowa, Kansas, and Missouri, we can get you competitive rates on high deductible Plan F. Those who qualify may be able to get a household premium discount in some states.

Weighing the Pros and Cons

While a $2,370 deductible seems high, this plan is attractive to folks who have a vast retirement savings amount. Usually, they can afford to spend some money out of pocket in a year where they use more healthcare services.

Again, the tradeoff here is paying lower premiums each month. Some people may change their minds after a few months and decide to apply for a standard Plan F — because they don’t like the bills they get up until they reach the deductible.

In our honest opinion, high deductible Plan F is an excellent value. You’ll save a lot of money in monthly premiums than if you enroll in a regular Plan F!

Contact Us for a FREE Online Quote

Want to see what your monthly premium would be for high deductible plan F? Contact Midwest Trusted Benefit for a FREE online quote.