Medigap Plan D

Medigap Plan D is one of the 10 Medicare Supplement options you can buy to add to your Original Medicare benefits. Don’t confuse Plan D for PART D, which covers retail prescription drugs.

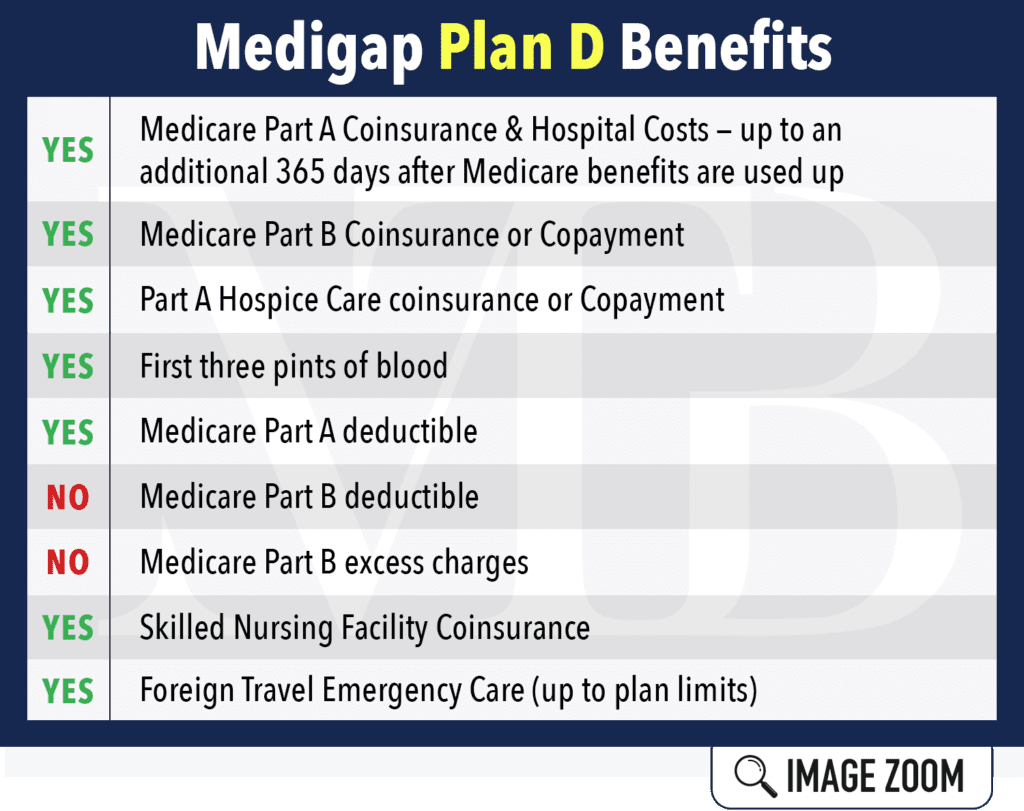

Medigap Plan D Benefits

Here’s a visual to understand the benefits:

Medigap Plan D Offers Great Coverage

A Plan D policy covers most of the Medicare gaps for you, minus the Part B deductible and any excess charges. An excess charge is an extra amount you’ll pay if a Medicare doctor charges more than what Medicare allows — up to 15% above it.

You’ll pay out-of-pocket for these two things if you buy a Plan D policy. However, it covers the most important items, such as the 20% of outpatient services you’d normally owe.

Is Medigap Plan D Right for You?

Your out-of-pocket costs will be minor with Medigap Plan D. When deciding which Medicare Supplement plan is best for you, you’ll want to compare pricing between D, F, and G — because F and G have strong benefits.

The question is: Are the savings worth the additional financial risk? Some people don’t mind paying more for their Medigap policy if it will cover every gap. Others would prefer cost-sharing to pay lower premiums. It’s your choice!

When Can You Buy Plan D?

The best time to purchase Plan D (or any Medicare Supplement) is during your six-month Medigap Open Enrollment period. During this time, you can purchase any policy sold in your state, even if you have health issues. Plus, you’ll usually get better rates and more choices among plans.

Your Medigap enrollment automatically begins the month you’re 65 years old and enrolled in Medicare Part B. After the enrollment period, you may not be able to purchase a Medigap policy. If you can, it will likely cost more.

Medigap Plan D Is Different Than Part D

People often get confused by Plan D and PART D. If this is you, you’re not the only one. It’s hard to master the Medicare terms with all these letters getting tossed around. We’ll explain the difference between Plan D and Part D.

Medicare Part D is the prescription drug benefit available to all recipients. It’s basically a pharmacy card you use when you pick up your doctor-prescribed medication(s).

Medigap or Medicare Supplement Plan D is just one of the many supplement policies available to you. For more questions, feel free to call us at (402) 740-5505.

Interested in Plan D? Contact Us

If you’re interested in the great benefits of Medigap Plan D, contact us for a FREE quote. Midwest Trusted Benefit works with the top companies in 15 states around the midwest. We’ll help you understand the coverage you already have and how a supplement policy can improve your situation.