Medigap Plan A

Medigap Plan A is the least complex of all Medicare Supplement plans and provides the least coverage. Still, it covers the most critical benefit: the 20% of outpatient medical care that Original Medicare leaves behind. Therefore, seniors should not overlook Plan A.

Medigap Plan A Coverage

Plan A coverage applies to hospital bills and coinsurance with all Medigap plans, even up to a year after Medicare benefits have been exhausted. Plan A covers Medicare Part B coinsurances and three pints of blood.

The coinsurance which comes along with a skilled nursing care facility stay isn’t covered. Medigap Plan A also doesn’t cover any deductibles.

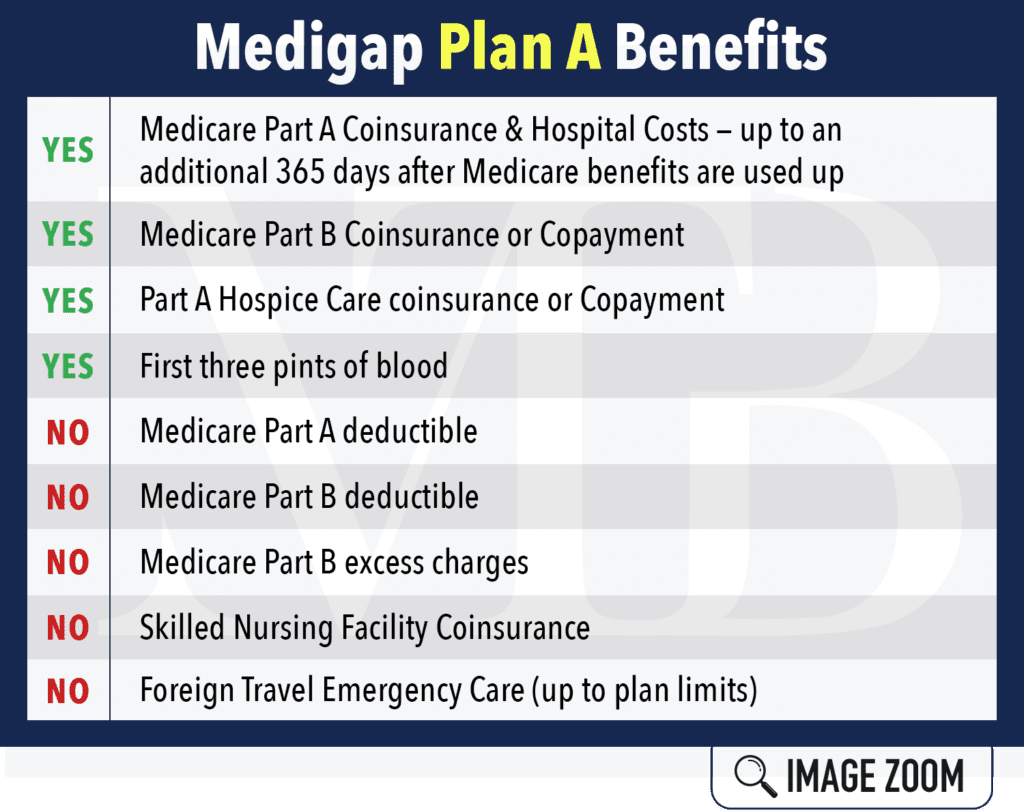

Medigap Plan A Benefits

Here’s a visual chart that can help you:

Medigap Plan A for Disabled People Under 65

In most states, Plan A is available to people under 65. If a disability makes you eligible for Medicare early, you can purchase this policy during your Medigap open enrollment period (without underwriting). However, Medigap for folks under 65 will cost significantly more than it will for 65 and older people.

This discrepancy in cost occurs because disabilities require more medical attention, which leads to higher costs than the average 65-year-old.

Plan A for People Over 65

For those over 65, Medigap Plan A will be priced like any other Supplement. But not many over 65 choose it — they often need more coverage for their health conditions. So, they opt for Plans like F, G, and N that provide more benefits.

Medigap Plan A Is Not Medicare Part A

Be careful not to confuse Medigap Plan A with Medicare Part A. They’re not the same.

Medigap Plan A is one of the ten standardized supplement plans that helps pay for what Original Medicare doesn’t. Medicare PART A, however, is your Original Medicare hospital insurance.

If these letters and plans seem overwhelming to you, you’re not alone. Midwest Trusted Benefit can help you understand your options and give you unbiased advice. Leave the insurance jumble to us.

Is Medigap Plan A Right for You?

Are you anticipating an inpatient hospital stay? Have you thought about the possibility of hospice admittance in the future? Are you going to have a procedure that may result in loss of blood?

If you answered yes to these questions, Medigap Plan A might be the right policy for you. Contact us today. Our agents serve many clients in 15 states around the midwest. We’ll be happy to answer your questions and provide quotes for the Medigap plan of your choice.